About Girin Market Models

|

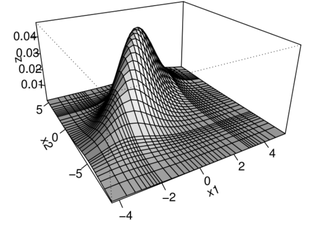

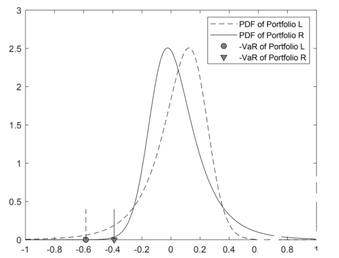

MNTS distribution and copula: The dependence structure in asset returns is explained by the correlation in classical finance. However, asset returns have asymmetric dependence which is not described by correlation. The MNTS distribution can capture the asymmetric dependence. The captured asymmetric dependence can be visually expressed by the MNTS copula.

|

Application of Girin Market Models

|

|

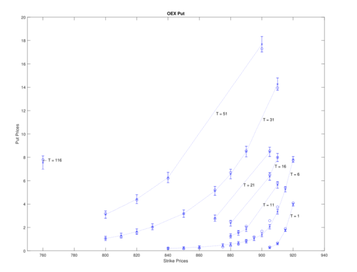

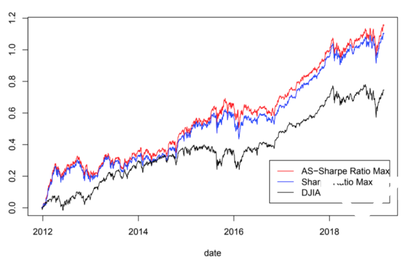

An in-depth guide to understanding probability distributions and financial modeling for the purposes of investment managementIn Financial Models with Lévy Processes and Volatility Clustering, the expert author team provides a framework to model the behavior of stock returns in both a univariate and a multivariate setting, providing you with practical applications to option pricing and portfolio management. They also explain the reasons for working with non-normal distribution in financial modeling and the best methodologies for employing it.

https://a.co/d/5ttuUZY |

Copyright 2021. Girin Instruments all rights reserved.